How to Continue My Social Security Benifits After Daughter Turns 16

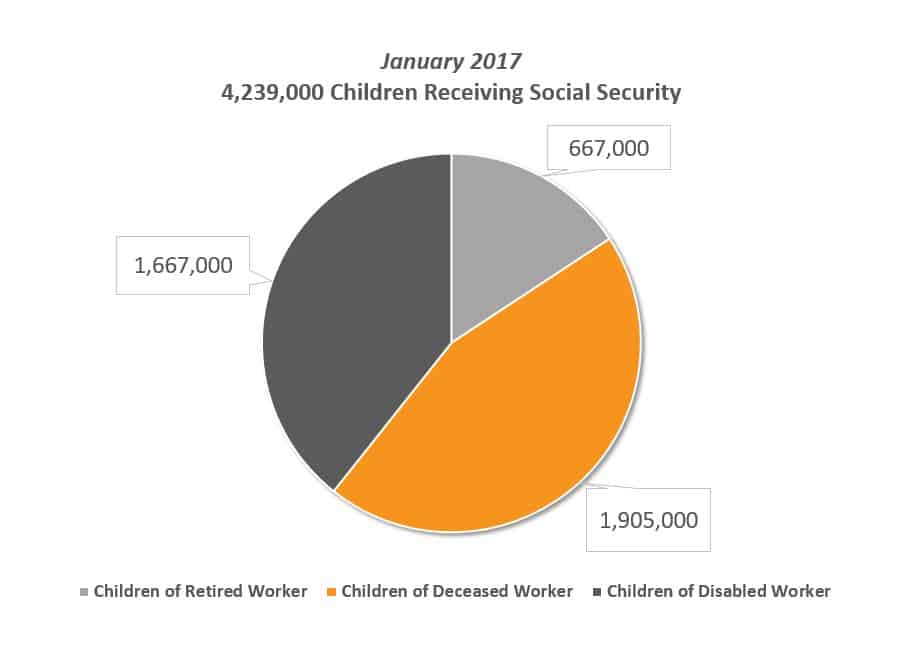

Social Security benefits for children are a big deal. In January 2017, there were more than 4.2 million children receiving Social Security benefits because one or both of their parents are disabled, retired or deceased. These benefit payments to children total more than $2.6 billion every month.

Sadly, many children don't get the benefits for which they are eligible. Most people don't know about the qualifications and rules for this special benefit, so they don't know to apply for the children in their lives.

Who Is Eligible for Social Security Benefits for Children?

A child who is your biological child, adopted child, or dependent stepchild is eligible for children's benefits if:

- you become disabled

- you retire

- you die

AND the child is:

- unmarried, and

- under age 18, or

- 18 or 19 if a full-time student in secondary school through grade 12 (see note below), or

- 18 or older and disabled with a disability that started before age 22.

Note: A 2022 report by the Office of the Inspector General found that the Social Security Administration erroneously terminated the benefits of students who turned 18. In their sample, they found that 87 out of 100 students were incorrectly terminated. They went on to further estimate that based on their sample results, they estimate SSA underpaid 14,470 beneficiaries approximately $59.5 million. Depending on the school schedule, benefits can be paid to a student through 19 years and 2 months of age. See the Social Security website section on this for more information.

What about Grandkids?

As long as the rules are followed, dependent grandchildren could be eligible for a benefit. I've covered this in-depth in my article Social Security for Grandchildren.

How Much Is The Benefit?

If you become disabled or retire, your qualified child is eligible for up to 50% of your full retirement age benefit.

If you die, your qualified child is eligible for up to 75% of your full retirement age benefit.

Family Benefit Maximum Limits

Although each qualified child may receive a monthly benefit payment based on your full retirement benefit amount, there is a limit to the amount the Social Security Administration will pay. They refer to this limit as the Family Benefit Maximum. This maximum benefit is not a set number but is about 150 to 180 percent of your full retirement benefit. Where your percentage falls depends on your full retirement age benefit.

There is one notable exception to maximum calculation. If you have a divorced spouse who is receiving benefits from your work record, it will not count in the family benefit maximum and it will not affect the amount of benefits you or your family may receive.

Children's Benefits and the Earnings Limit

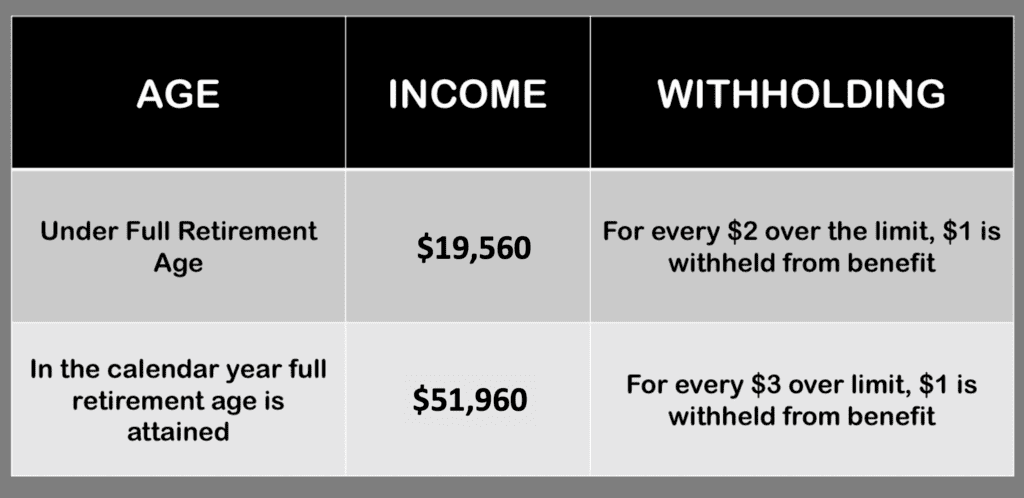

If a child is receiving benefits from Social Security, they are subject to a limit on the amount of earnings they can receive from wages or net earnings from self-employment. These income limits change on an annual basis and listed below is the limit amount for 2020.

It should be noted that your child's earnings affect only their own benefits and not yours or those of any other beneficiaries on your record. For an in-depth view of the Social Security earnings limit, see my article on this subject.

Strategy: Why Filing Early for Retirement Benefits Could Be Best

Unfortunately, you don't get much of a say so as to when you file for survivors benefits or disability benefits. But you DO get to decide when to apply for your retirement benefits. For a household with children, the decision when to begin receiving Social Security retirement benefits is just more complicated. The penalty for not understanding the rules and the resulting difference in lifetime benefits can be enormous.

In many cases, there are many reasons to delay filing for social security benefits. But not all cases are the same! If you have kids at home, and are thinking about filing for Social Security, filing early could make more sense. Why? Your children cannot collect a Social Security benefit until you file.

Consider the difference in lifetime benefit amounts for a couple with the following circumstances.

Roger is 62 and his wife is 46. They have two kids at home, ages 8 & 10. Roger is financially well off enough to stop working and can be flexible on what age he begins to collect Social Security.

If Roger waits until his full retirement age, he'll get $2,000 per month. If he files now, he'll only get $1,500 per month. He ran the numbers and figured out that if he lived to 90, he'd receive an additional $70,000 in benefits for delaying filing until 66 instead of filing at 62.

For most people, this math shows that it makes sense to delay receiving benefits. However, this does not account for the benefits paid to the children. While the children are eligible for benefits based upon Roger's retirement, the kids cannot get benefits until he files. Roger's family would able to collect thousands of dollars more in lifetime benefits if Roger files early and turns on the benefits for his children.

Here's how…

If you run Roger's full retirement age benefit through the family benefit calculator, you'll arrive at a maximum benefit of approximately $3,500 . If Roger files at 62 he'll receive $1,500 and each of his children would be eligible for $1,000 in children's benefits. That additional $2,ooo per month ($1,000 for each of the children) is only available if Roger files for Social Security.

Reporting Requirements

Whenever a minor child receives a benefit, the Social Security Administration pays the benefit to a representative payee. This individual is often a parent and is responsible for managing the benefits on behalf of the child.

Before a recent law change, all representative payees were required to file an annual report. However, due to a recent change in the law, the SSA no longer requires most parents or guardians to complete an annual Representative Payee Report.

Even though the SSA doesn't reuire an annual reporting, they do have the following cautioning language. "All payees are responsible for keeping records of how the payments are spent or saved, and making all records available for review if requested by SSA."

If you haven't spent all the money, the SSA will require you to send it back to them when your child turns 18. This is because your child is considered an adult in their eyes and they will begin to deal directly with them.

This surprises many who were trying to do the prudent thing and save the checks for the child's car, college tuition or some other important expense. You can see the Social Security Administration's page titled "Transfer of Conserved Funds" on this topic for more information.

Are Children's Benefits Taxable?

One of the most frequently asked questions about Social Security Children's benefits is, "Are these benefits for children considered taxable income?"

The short answer is that they are taxable, but that doesn't mean your child will have to pay tax on them.

The taxation of these benefits is determined using the income of the child. Generally speaking, if the child's total income plus one half of their Social Security benefit does not exceed $25,000, then no taxes will be owed. You can read more details on the IRS page dealing with children's benefits.

How To Apply For Child Benefits

You can apply for benefits at your local Social Security office or via phone.

Ready to start your application for benefits for your child? Review the Information You Need To Apply For Child's Benefits page on the Social Security website to ensure you have all the necessary documentation.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It's very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I'll even drop in to add my thoughts, too. Also…if you haven't already, you should join the nearly 400,000 subscribers on my YouTube channel!

buzacottloself1990.blogspot.com

Source: https://www.socialsecurityintelligence.com/social-security-benefits-for-children/